WWF Tool Helps Banks Spot Environmental Crime Risks 🕵️♂️"

“Despite its rapid growth, environmental crime is rarely seen as a serious risk by financial institutions"

This article by Kristine Sabillo originally appeared in Mongabay.

WWF has released a toolkit that will help financial institutions spot and reduce their risk to environmental financial crime exposure.

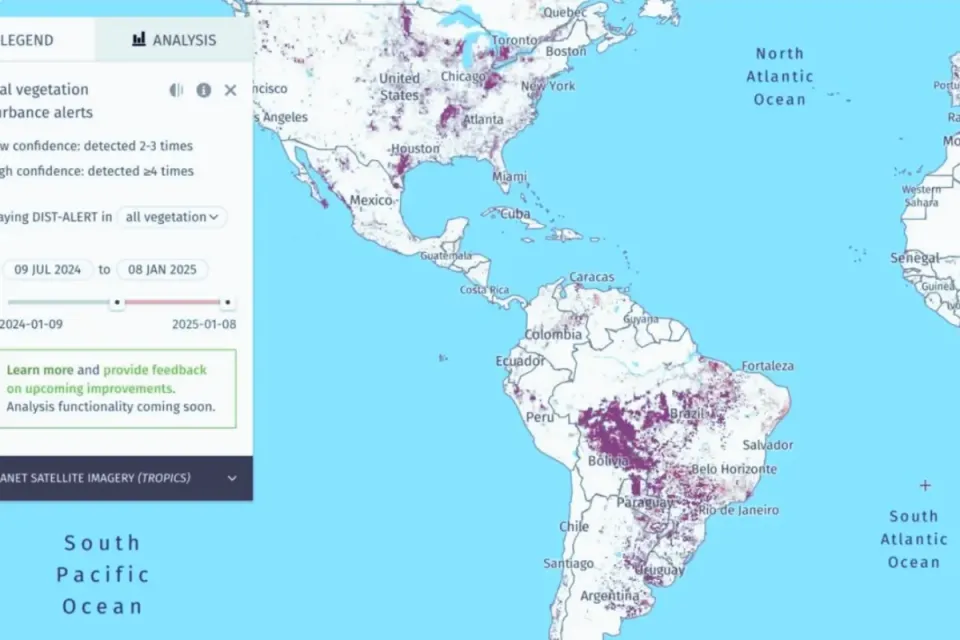

The new Environmental Crime Financial Toolkit (ECFT), which WWF co-developed with financial crime software company Themis, is an open-access platform designed to help financial institutions screen new clients and review existing ones, as well as identify risks related to land conversion, such as deforestation, that could be linked to financial crimes, WWF-UK drivers initiative lead John Dodsworth told Mongabay in an email. This, in turn, is meant to help the firms minimize their exposure to environment-related illegal activities.

WWF notes on its website that environmental crime, which is worth hundreds of billions of dollars annually, is the third-largest illegal activity globally. These crimes continue to grow by 5-7% per year, according to Interpol.

In a joint report published earlier this year, WWF and Themis noted that some 150 financial institutions had provided $6.1 trillion in funding to “350 companies with the greatest risk exposure to tropical deforestation” in 2023. Financial institutions can be exposed to potential illegal activities when they finance commodities linked to land conversion and deforestation, such as palm oil, cocoa, timber, coffee, minerals, oil and gas.

In the same report, the results of a survey by WWF and Themis showed that of 644 financial services professionals interviewed from 17 countries, 60% said their company did not have a land conversion risk policy. Half of the firms surveyed also worked with high-risk sectors at some point, but only 17% of them screen companies and clients on an ongoing basis, the survey found.

“Despite its rapid growth, environmental crime is rarely seen as a serious risk by financial institutions, but it in fact poses significant reputational and material risks to their operations, such as the potential of sanctions for enabling illegal activity,” WWF-UK CEO Tanya Steele said in a statement.

Themis CEO Dickon Johnstone added the toolkit is aimed at helping companies “understand and mitigate these risks, thereby protecting themselves and wider society and the environment from the devastating impacts of environmental crime.”

WWF’s Dodsworth told Mongabay that through the ECFT platform, users would be able to assess risks associated with specific commodities in different countries, and search for case studies and identify possible red flags. He added the toolkit will increase firms’ “ability to cross check information that is presented and in some cases to prompt additional questions or requests for information from the client.”

Dodsworth said the development of the toolkit was supported by the Climate Solutions Partnership, a five-year collaboration between WWF, the nonprofit World Resources Institute, and U.K. bank HSBC.

WWF has already held workshops with financial institutions and sector experts and government, “which have all showed interest in using the toolkit and incorporating this into their processes,” Dodsworth said.

License

Sabillo, Kristine. "WWF Gives Banks a Tool to See if They’re Financing Environmental Crime." Mongabay, November 14, 2024. Republished under a Creative Commons Attribution ND 4.0 license.