Voluntary Carbon Market: Buyers Demand Transparency and Quality

Buyers prioritize transparent reforestation (ARR) credits, paying more for verified impact in the evolving carbon market.

The Voluntary Carbon Market (VCM) is evolving, and buyers are becoming increasingly discerning. According to the latest Boston Consulting Group (BCG) and Environmental Defense Fund (EDF) report, companies are willing to pay a premium for high-quality, transparent carbon credits. And when it comes to Afforestation, Reforestation, and Revegetation (ARR) credits, the emphasis is shifting from quantity to verified impact. Let’s break it down:

ARR: A Market Shift Toward Verified Reforestation

Reforestation credits have been a staple of voluntary carbon markets, but buyers are no longer satisfied with broad claims of future sequestration. They want concrete evidence that their investments lead to actual, long-term carbon removal.

- Afforestation & Reforestation (ARR) credits averaged between $8–$15 per metric ton in 2022, a premium over other credit types such as energy efficiency credits ($2–$6 per ton).

- Companies are prioritizing removal credits (like ARR) over reduction credits (such as renewable energy offsets) because their impact is easier to measure and verify.

- By 2030, demand for voluntary carbon credits is projected to reach between 330 million and 1.5 billion metric tons CO₂e, a sharp increase from 160 million metric tons in 2022—a fourfold growth in just five years.

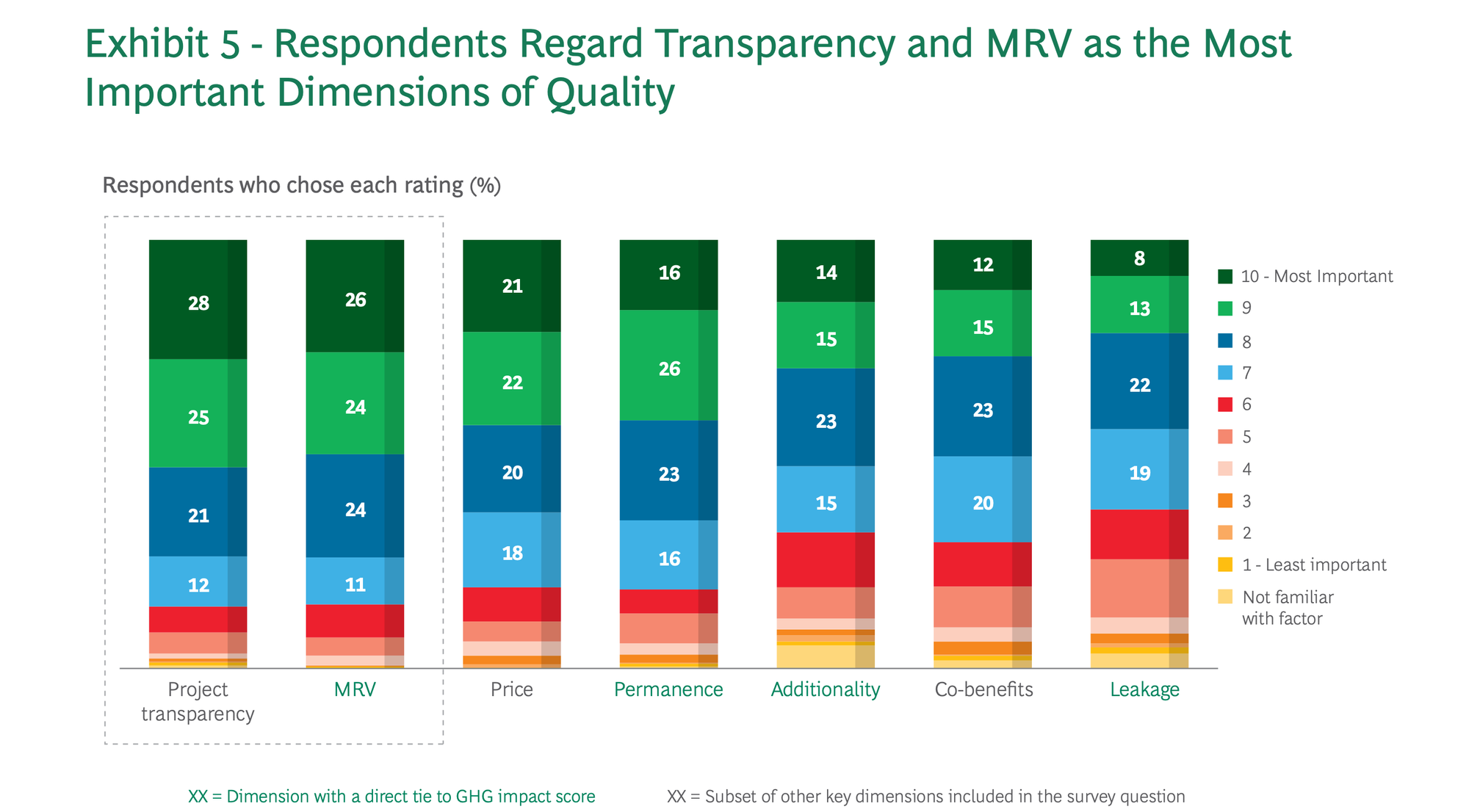

- Buyers are willing to pay up to 50% more for ARR credits that incorporate robust Measurement, Reporting, and Verification (MRV) systems to ensure their effectiveness.

Transparency is the Defining Factor

Buyers are not simply looking for cost-effective credits—they are prioritizing quality and verifiability. Companies recognize that reputational risk and regulatory scrutiny demand a higher standard of transparency.

- GHG impact score is the top priority for buyers when selecting carbon credits.

- Jurisdictional REDD+ (JREDD+) credits—which support large-scale forest conservation—are becoming increasingly preferred due to their greater permanence and lower risk of leakage.

- 85% of surveyed companies plan to increase their voluntary carbon credit budgets, but only for high-quality, well-documented projects.

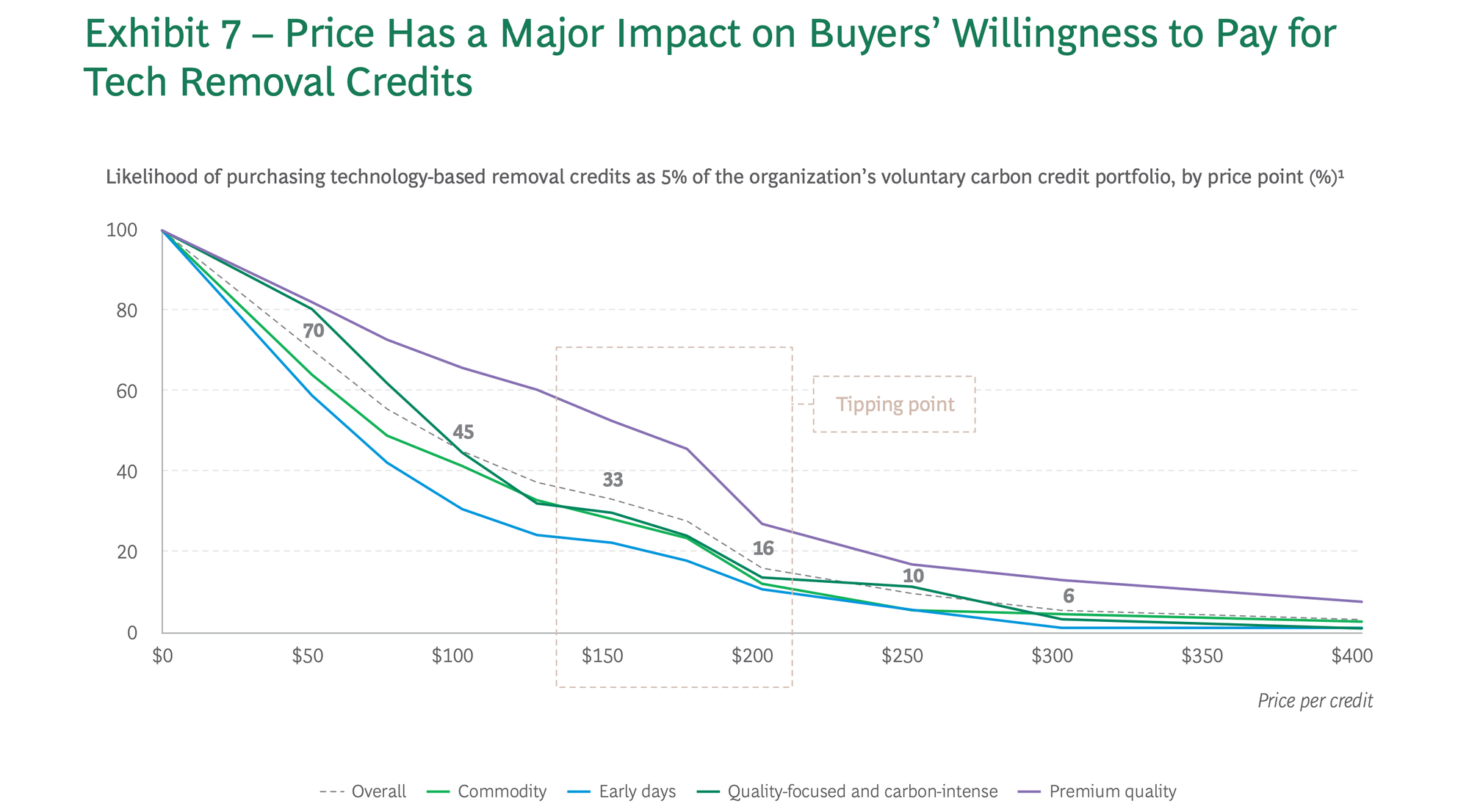

- Some engineered removals (such as Direct Air Capture) remain costly, with buyers only willing to pay up to $200 per ton, limiting their near-term scalability.

What This Means for the Future of Carbon Markets

The findings point to a clear direction for project developers, investors, and corporate buyers: high-integrity carbon credits are not just preferred—they are essential. To remain competitive, the market must adapt to this growing demand for quality.

✅ Prioritize verifiability. Credits backed by strong monitoring and reporting will attract the highest value.

✅ Scale jurisdictional approaches. Large-scale JREDD+ projects are gaining traction and offer a stronger guarantee of permanence.

✅ Expand beyond carbon. Buyers are looking for biodiversity and community co-benefits alongside emissions reductions.

✅ Prepare for rising prices. Carbon credit prices are expected to increase to $25–$30 per ton by 2030, compared to the $4–$8 average in 2022.

The takeaway? High-quality, transparent ARR credits are the future of the voluntary carbon market. Buyers are ready to invest—but only in projects that can prove their impact.

For enthusiasts of open data in nature-based solutions, this report arrives at a critical moment. As Ground Truth has emphasized elsewhere: openness is one of the key antidotes to greenwashing.

The message is clear: show us, don’t tell us about it.

Citation:

Ponce de León Baridó, P., Nielsen, J., Porsborg-Smith, A., Pineda, J., Owolabi, B., & Gordon, M. (2023). In the voluntary carbon market, buyers will pay for quality. Boston Consulting Group & Environmental Defense Fund.

Edited by Chris Harris

This work is licensed under a

Creative Commons Attribution 4.0 International License.