Red Sea Deals, Mast’s Burial Credits and Netflix Forest Bets

From burial credits to watershed bills, forest finance is evolving—linking land, carbon, and policy across sectors and geographies.

From Palo Alto to Pará: Mombak’s $30M Bet on the Amazon

Mombak’s $30 million Series A is more than a climate tech raise—it’s a blueprint for how reforestation deals can blend venture capital, carbon markets, and sovereign finance. With USV, Bain, and Brazil’s own BNDES backing native tree planting across degraded Amazon land, the startup is proving that carbon removal can go from pitch deck to planted roots. Eight million trees, hundreds of millions in carbon offtakes, and the legal muscle of Gunderson, Pinheiro Neto, and Trench Rossi are turning Brazil’s climate economy into investable terrain.

💬 Are we finally seeing climate restoration emerge as a proper asset class—or just the world’s most ambitious green gamble?

👉👉 Read more in Beyond the Law

Can Bipartisanship Bring Forests—and Water Systems—Back to Life?

The Headwater Protection Act, co-sponsored by a cross-party group of U.S. senators, aims to triple funding for forest and watershed restoration through the U.S. Forest Service. It’s a timely push: communities in New Mexico are still grappling with fire scars, flood risks, and months of bottled water after the Hermits Peak-Calf Canyon Fire. The bill would open funds to acequias and land grant-mercedes—centuries-old systems tied to land and water in the Southwest. Whether this signals a new era of proactive forest-water policy or just a rare political alignment remains to be seen.

💬 Can targeted investments in watersheds rebuild trust—and resilience—where fire and neglect have taken their toll?

👉👉 Read the story in Source NM

When Finance Meets Roots: Africa’s Climate Solutions Get a Boost

At the Africa Climate Summit, a new framework—anchored by the Climate Justice Impact Fund—is putting grassroots ingenuity front and centre. From soil-healing in Senegal to aquaculture in Kenya’s deserts, the projects are as local as they come, and the message is clear: climate resilience doesn’t need to be imported. But with just 4% of global climate funds reaching Africa, scale remains the sticking point. Can catalytic grants lure private capital—or will local brilliance keep waiting for global trust?

💬 Is this finally the shift where climate finance follows the solutions—not the other way around?

👉👉 Read the article in TIME

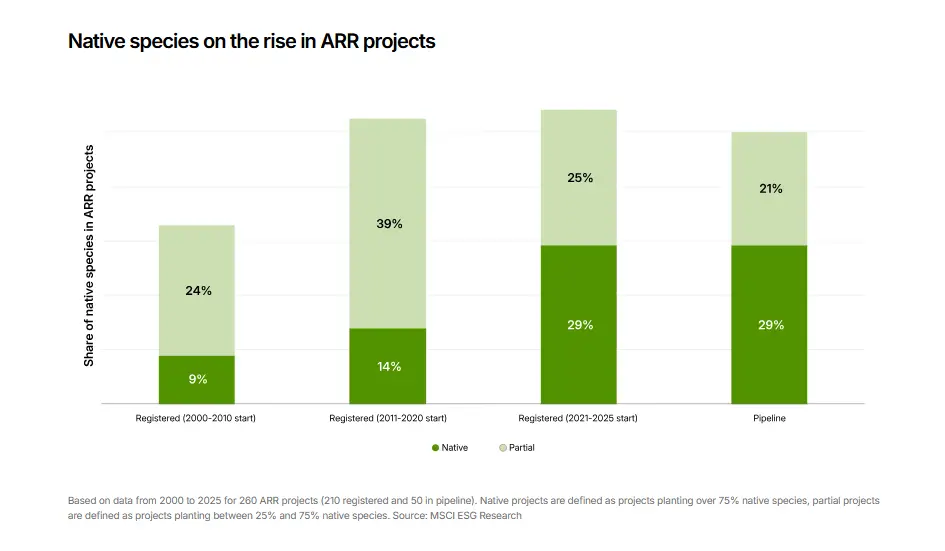

Native Species Gain Ground in ARR Carbon Markets

In the evolving world of afforestation, reforestation, and revegetation (ARR), native species are staging a quiet takeover. Once rare, native-dominant projects now make up a third of the market, according to MSCI’s latest carbon project analysis. While non-native monocultures still offer revenue appeal, project developers are leaning toward biodiversity-rich approaches—often exceeding protocol requirements—to meet rising investor and buyer expectations. The result? A rare sweet spot where carbon, credibility, and co-benefits all align.

💬 Is the native species shift a market correction—or the start of a new standard?

👉👉 Read more in MSCI

Netflix Bets on Pine Trees and Family Forests in 15-Year Carbon Deal

Netflix has inked a 15-year deal with the American Forest Foundation to buy carbon credits from its Fields & Forests program—turning underused farmland into carbon-sucking, biodiversity-boosting forests. The agreement aims to cover 75,000 acres by 2032 and deliver 4.8 million verified credits, with small family landowners at the center. The twist? It’s all powered by milestone prepayments—a financing model that helps landowners overcome upfront costs, from soil prep to sapling care.

💬 Could milestone financing be the missing link in scaling forest carbon without leaving smallholders behind?

👉👉 Read more via ESG News

IFC Eyes $25M Bet on AXA IM’s Nature-Based Carbon Fund

The International Finance Corporation is considering a $25 million commitment to AXA IM Alts’ new Natural Capital Opportunities Fund—a closed-end vehicle aimed at delivering high-integrity carbon credits through afforestation, land restoration, and wetland revival. If approved, the IFC's backing would give a boost to AXA’s $150 million fundraising target, with credits split between carbon removal and avoidance across Asia, Africa, and Latin America.

💬 As natural capital finance scales, can these blended vehicles balance carbon, credibility, and commercial returns?

👉👉 Read more in Agri Investor

When the Leaves Speak First: Climate Shocks Reshape Forest Asset Value

In North America, forests are no longer just carbon sinks—they’re climate risk indicators. New research links early leaf fall to soil moisture deficits, revealing how drought shortens growing seasons and cuts into forest productivity. As traditional land valuation models falter under compounding stressors, a new toolkit—satellite analytics, AI irrigation, mixed-species planting—is starting to emerge. For investors, resilience is no longer a buzzword—it’s a balance sheet metric.

💬 Are we finally listening to the forests, or still pricing them for a past that’s not coming back?

👉👉 Read more in AI Invest

$18.6 Billion for a Red Sea Paradise—But How Green Will It Really Be?

Emaar Misr and Gulf investors are pouring $18.6 billion into Marassi Red Sea, a mega tourism complex on Egypt’s coast complete with floating cabanas, marinas, malls—and promises of large-scale reforestation. It’s being hailed as a sustainable showpiece. But amid luxury and spectacle, one question lingers:

💬 How much is actually going to reforestation—and will we be able to see the results, or just read about them?

👉👉 Read more in Ecofin Agency

Trees in the Fine Print: Is Reforestation Getting Its Due in Nature Finance?

The WEF Finance Solutions for Nature 2025 report shows that while nature-based solutions are gaining lip service, they’re still scraping by with just a fraction of climate finance—roughly $200 billion out of $1.3 trillion, with even less from private capital. Reforestation is repeatedly named as a top-impact solution, yet bottlenecks in investment readiness, policy gaps, and poor outcome tracking keep it sidelined. Despite strong potential for carbon removal and co-benefits, actual pipeline-ready projects remain scarce.

💬 So, if trees are such a good bet—why isn’t the money following them?

👉👉 Read the report from the WEF

Bury It to Save It: Is Biomass Burial the New Frontier in Nature-Based Carbon Storage?

Mast Reforestation has wrapped up its boldest climate play yet: burying over 10 million pounds of fire-killed trees at its Montana MT1 site, turning post-wildfire debris into durable, soil-sealed carbon credits. This hybrid project blends engineered “biomass burial” with reforestation—adding seedlings from nearby wild seed to restore local forests. With a BeZero-rated “A-pre” MRV system and credits on sale ahead of issuance, it's collapsing multi-year carbon delivery timelines into one.

💬 Biomass burial mints carbon credits fast—but is this a scalable solution, or a clever fix for a uniquely fire-ravaged landscape?

👉👉 Read more on Yahoo Finance

Brazil’s Forest Fund Gets Ready for Its Close-Up—But Will Nature Benefit?

Brazil’s Tropical Forest Finance Facility (TFFF), a market-based fund to reward nations for protecting standing tropical forests, has just picked up endorsements from BRICS and Amazonian neighbors ahead of its COP30 launch. Designed to channel $25–$125 billion into forest conservation, the fund hinges on forest performance, satellite monitoring, and a revenue model targeting steady investor returns of 4–4.5%. But critics warn TFFF risks commodifying forests and obscuring intrinsic biodiversity value behind financial incentives.

💬 When the forest is a performance metric, how do we know reforestation won’t become just another line on a climate balance sheet?

👉👉 Read more in Mongabay

Edited by Chris Harris

This work is licensed under a

Creative Commons Attribution 4.0 International License.